Doesn’t it just seem like everything just keeps getting more and more expensive these days? No matter how hard we work, it feels like our money is always slipping through our fingers faster than we can earn it. Inflation really feels out of control sometimes, right?!

The truth is, as frustrating as it is, there isn’t much we can do personally to change those big economic trends. But you know what we CAN control? How far our dollars stretch each month. Learning to save smart with proper spending habits is the best way to protect your financial goals as costs keep rising!

That’s why today, we’re sharing a round-up of tried-and-true money-saving hacks. Think of it as your very own financial toolkit. These tactics have seriously helped SO MANY people make every dollar count–no matter what’s happening in the economy. It doesn’t matter if you’re shopping for groceries, planning nights out with friends, or just treating yourself. These money-saving tips will have you saving without even thinking about it!

By the end, you’ll be feeling like a total money pro with the power to stretch your cash further. So, are you ready to take control and maximize your purchasing power?

If so, read on!

Best Money Saving Hacks

Money-Saving Travel Hacks

Be flexible with your travel dates.

Be open to adjusting your travel dates by a few days or even weeks. This flexibility can make a HUGE difference in airfare and accommodation costs.

By being flexible (and we’re not just talking about in your yoga class) you can save some serious cash, allowing you to allocate that extra money towards more exciting experiences during your trip. Just like that, there’s more opportunity to explore local cuisine, pamper yourself, or snag that perfect souvenir. Uhm…yes, please!

Embrace the sharing economy.

Dive into the sharing economy by considering homestays, vacation rentals, or house-swapping. Sites like Airbnb and VRBO offer authentic accommodations at uber affordable rates. Honestly, these alternatives often offer a more immersive experience at a fraction of the cost of traditional hotels anyway!

You can expect to save a great deal on accommodation costs with the sharing economy. This just might also allow you to stay longer or visit more destinations within your budget. It’s a real win-win!

Travel light.

If you’re like us, you HATE a bag fee–UGH! Instead of paying extra for bags, pack efficiently and aim to travel with just a carry-on bag. Layer your versatile pieces the right way. Roll instead of fold, and pack ziplock bags of toiletries. This not only minimizes baggage fees, but it also ensures you’re not over-packing and lugging around extra annoying weight.

You can easily save per flight on baggage fees and even better, avoid the hassle of waiting at the dreaded baggage claim. With a lighter load, you’ll move more freely, explore with ease, and keep more precious, precious money in your pocket.

Make the most of travel rewards credit cards.

Love getting rewarded for spending? US TOO! Choose a travel rewards credit card that aligns with your travel goals. These cards often offer sign-up bonuses, rewards points, and travel insurance.

With careful use (emphasis on careful, babes), they can help you save hundreds on flights, hotel stays, and even car rentals. Unlock incredible benefits like complimentary lounge access and priority boarding, elevating your travel experience. Sign us up!

Eat like a local.

We know you want to try out those touristy restaurants and enjoy the glamor, but why not seek out local eateries and food markets? You can simply ask the hotel staff or locals where they dine, and trust us when we say, it’s going to be a lot cheaper.

This not only introduces you to authentic cuisine but also saves you money. After all, discovering hidden culinary gems is a cultural experience in itself, offering a taste of the destination’s heart and soul.

Money-Saving Beauty Hacks

Give yourself DIY spa days.

Believe it or not, you CAN transform your home into a spa haven with affordable skincare products, essential oils, and relaxing music. Oh, and the HOT MESS ICE ROLLER. Learn to always set aside some dedicated self-care time to complete your expert skincare routine, and you might just save big.

Because you CAN enjoy spa-like experiences without spending hundreds at a spa. Moisturize with face masks made with avocado, honey, and yogurt. Dim the lights and meditate to fully unwind. Try waxing at home. The options to save with DIY beauty are ENDLESS.

Simplify your beauty routine.

Multi-use products are where it’s at. Look for items that can serve as a blush and lip color, or a highlighter and eyeshadow. This way you need to buy fewer products! If beauty is totally out of your comfort zone or changing your routine FREAKS you out, listen to this episode of Lipstick on the Rim about keeping it simple at the vanity!

For simple skincare hacks, beauty tips, and secrets, listen to Lipstick on the Rim with Molly Sims.

Leverage on online coupons.

Before any beauty shopping spree, hunt for online coupon codes or check store promotions and loyalty programs. You can save a lot by sticking loyal to a brand. But, you can also download Honey which automatically searches for coupons and applies them at checkout. It’s totally addicting and helps you save sooo much!

Bookmark websites like RetailMeNot and look for coupon codes before each supply shop. Drugstore loyalty programs like CVS ExtraBucks offer rewards every time you shop too. Consistently save more on your favorite beauty brands with online coupons. You get to also keep your makeup collection refreshed without emptying your wallet.

Make the most of DIY remedies.

If you love a facemask but hate both the expense and environmental impacts of grabbing those single-use plastic packages over and over again, remember you can make them at home! You can always create homemade face masks using kitchen ingredients like honey, yogurt, and oatmeal. Charcoal masks with aloe vera are good for deep cleaning pores. Oat flour and honey is great for hydration. The point is, do the mask thing yourself next time.

Swap store brands for name brands.

Compare the ingredients and quality of store-brand beauty products to name brands. Lots of times, they’re totally the same ingredients and you’re literally just paying for a name brand. So, swap the items if you can.

Money-Saving Food Hacks

Master the art of batch cooking.

On the weekends, you can plan simple recipes like soups, stews, casseroles, and freezable sides to avoid blowing money eating out or buying too many ingredients. Simply dedicate a few hours to prepping ingredients and doing all the cooking at once. Portion meals into individual containers for the freezer. On busy nights, you can just reheat a ready-made meal. It’ll help you eat healthier, too!

Embrace thrifty meal planning.

Try to dedicate time to browsing your favorite budget-friendly recipe sites like Budget Bytes, Half Baked Harvest, or Skinnytaste for inspiration. Make a meal plan for the week and shop just once with a list. Stick to your plan and cut off a good percentage off your monthly grocery bill. WHOA! Serious savings.

Power up with leftovers.

Don’t toss extras away. You can always repurpose them into new dishes while rocking The Breadwinning Housewife Apron! 😉 For example, you can take last night’s chicken and rice, stir fry it with veggies, and BAM–you now have fried rice. You can even mix something as simple as mashed potato scraps into potato cakes. YUM!

With just a bit of mix-and-match creativity using odds and ends in the fridge, you can save a couple of dollars each and every week on meals. The same amount would have otherwise been tossed or have required a totally new trip to the store, so it’s truly a win-win.

Join a food co-op or farmers’ market.

Food co-ops welcome members to purchase organic goods together directly from farmers. Plus, local farmer’s markets put you in touch with growers. By becoming a member of a local food co-op, you get weekly discounts on local produce and can also take advantage of bulk bins to portion out grains, legumes, and dry goods yourself for major savings.

Between these two programs, you could get massive savings on high-quality local produce. You can consider signing up for a weekly Community Supported Agriculture (CSA) box of seasonal fruits and veggies, too.

Magnify flavor with seasonings.

Stock your spice cabinet with different herbs, spices, broth, and condiments to take your simple meals to new heights. A splash of soy sauce or harissa can transform a basic soup. Experiment to satisfy your taste buds WITHOUT pricey add-ins.

Relying on flavor bombs rather than pre-made or out-of-season ingredients is a good way to save a couple of bucks here and there. Over time, cutting back on the excesses of convenience foods and sauces will see you having extra cash.

Money-Saving Grocery Hacks

Craft a shopping list and stick to it.

Creating a detailed list based on your meal plan is key. Take time to identify the ingredients needed for each recipe before heading to the grocery store. Then, only shop for items on your list to avoid overspending on impulse purchases. Pro tip: try to create meals that use the same ingredients!

It is one thing to craft a shopping list, it’s another thing to have the discipline to stick with it. Sticking rigidly to your list can help you lower grocery costs by a significant amount each trip. For more on how to break bad money habits such as impulse buying, listen to this episode of ILYSM about budgeting money management.

The store brand advantage.

Don’t shy away from store-brand products; compare ingredients and quality to name brands. Believe it or not babes, you’ll often find them just as good. Store brands offer significant savings without compromising quality.

Take a few minutes to compare ingredient lists and nutrition facts with name brands. You’ll often find store labels to be just as tasty for 15-30% less money. Going for generics over name brands is a great way to save money on groceries.

Leverage coupons and cashback apps.

Digital coupons and cashback apps are invaluable resources for slashing grocery bills. The rave for these benefits are still on, so get in on the action to score discounts on your favorite items.

Look up offers before shopping to avoid impulse buys and clip all applicable coupons. You can typically save $10-20 per trip with minimal effort. Staying on top of deals ensures your grocery budget goes EVEN FURTHER each month.

Watch for sales cycles and discounts.

Pay close attention to stores’ sales cycles and stock up when prices are lowest. Then, take advantage of those discounts on non-perishable items and essentials. With good timing, you can save big on staples, often up to 40% off regular prices. HOLY COW!

Avoid running low on key items so markdowns don’t go to waste. Strategic shopping habits maximize your grocery budget and help you save a few dollars.

Buy in bulk where It counts.

Bulk purchasing allows you to take advantage of great per-unit pricing. Items like paper goods, baking goods, and cooking staples fare well in bulk and are totally worth it when you use them every single day. Make the most of bulk sales or and take advantage when these items are offered at warehouse stores!

Buying larger sizes can shave 30% or more off your annual grocery spending with just a small upfront investment. You get to have a well-stocked pantry AND some cash left to indulge in other things.

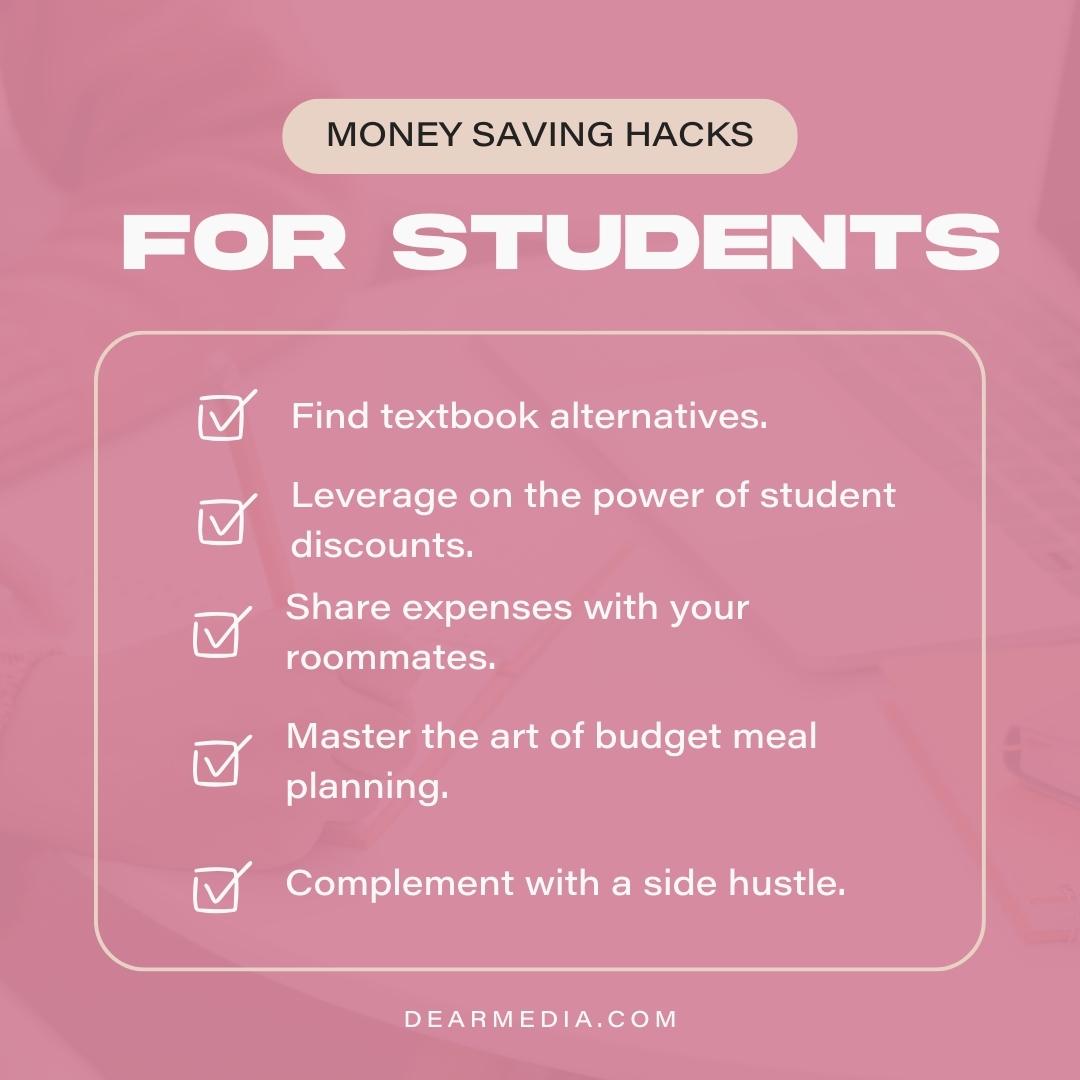

Money Saving Hacks for Students

Find textbook alternatives.

Required textbooks can be such a drain on your finds while in school. This is why you should always explore other alternatives to buying brand-new textbooks. You can always check to see if you can rent, find used copies online, or even download free PDF versions.

With this tip, you get to save potentially hundreds of dollars per semester by avoiding the high cost of brand-new textbooks.

Leverage on the power of student discounts.

Do not miss out on the loads of student deals that are out there. From clothing stores to restaurants, someone is trying to hook you up… if only you just ask. Student status can be your golden ticket to savings. So, always inquire about student discounts wherever you shop, dine, or travel!

You can enjoy discounts of up to 20% on various expenses, from clothing to transportation. This helps you create opportunities to save, indulge, and expand your college experience!

Share expenses with your roommates.

Sharing expenses with your roomies can be a total lifesaver. You get to split everything like rent, utilities, and groceries. Eventually, your share of the bills comes out so much cheaper than living alone. You can even have a meal plan together, taking turns cooking big batches for the week. It also saves you from the temptation to order expensive takeouts all the time!

You could potentially save thousands of dollars over your college years by sharing expenses. It makes for a more affordable living situation and a better sense of financial security!

Master the art of budget meal planning.

Meal prepping is a must if you’re looking to save money as a student. Plan out your meals in advance and create a shopping list. Stick to your budget by avoiding costly dining out.

Trim your monthly food expenses by up to $100 or more. Your take-home from this hack? Well, improved cooking skills, healthier eating habits, and more money to invest in your school experience.

Complement with a side hustle.

With tuition and books, you will likely need some extra income flow from here and there. So in your free time, you can explore part-time jobs, freelancing, remote work, or hobbies that make money. This creates opportunities for you to earn extra money while balancing your studies.

Interested in podcasting as a side hustle? Learn how to make money from podcasting. No matter what you choose–side gigs have the potential to boost your savings by a few hundred dollars every month, while still allowing you to focus on school.

You can also listen to this episode of Life With Me with Marianna Hewitt to learn how to diversify your income through a side hustle!

Put these hacks to work and watch your savings pile up.

Ready to start stretching your dollars further than ever before? You can be sure that putting even a few of these money-saving strategies into action will add a great deal to your personal finances. And there’s still much more. You can ditch your gym membership for outdoor workouts, try washing your clothes in cold water, carpool, and so on to work up different ways to help your wallet.

The extra cash could mean knocking out those pesky credit card balances once and for all. Or, maybe even boosting your emergency fund so you’ll feel secure no matter what. You might even reach savings goals that once seemed impossible. Just think about all the things you could treat yourself to or experiences you could have when your money is working harder for you!

Check out our list of best finance podcasts to learn from the best on how to go about making money, saving money, spending money, and so on. For more quality tips like the ones above, head to the Dear Media blog where we always have an answer to the questions you didn’t even know you were asking!